Banking today mostly comprises of several oligopolies that define the market dynamics, rate of innovation, and quality of services that the consumers experience. Open banking has been introduced to make banking a more competitive business. Its main goals are offering greater financial transparency, a shared chance of success for all financial service providers, and more innovative services to the consumers.

Payment Services Directive 2 (PSD2) requires banks to securely expose customers' accounts and transaction data to third parties through open APIs, with the customer's consent. This allows new third-party service providers to enter the market, leading to more competition, greater choices, and better services to consumers.

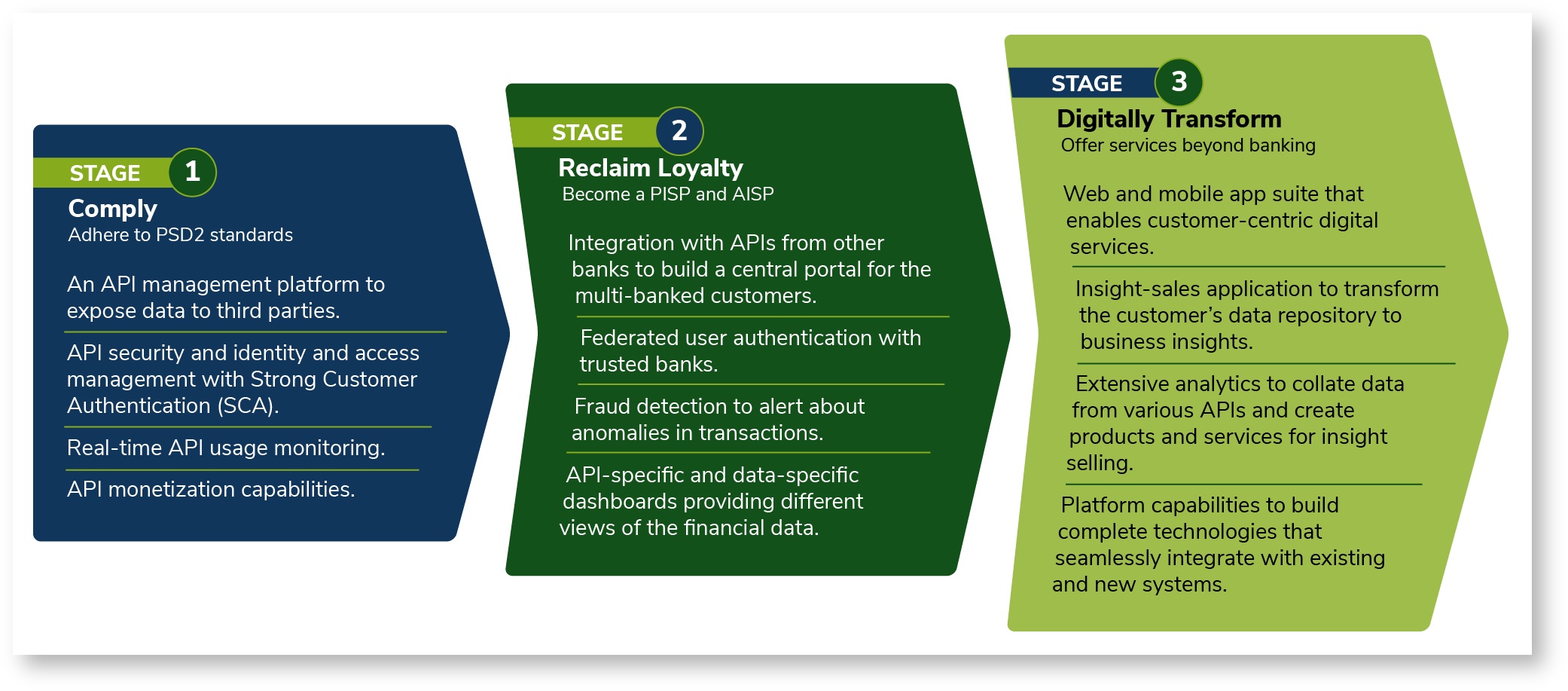

WSO2 Open Banking provides the technology requirements that banks need in order to become digitally transformed in three stages. It leverages five key technology areas critical to a banking infrastructure—API Management, Identity and Access Management, Integration, Data Analytics, and IoT.

- Become PSD2 compliant by exposing APIs securely and in-line with the Regulatory Technical Standards (RTS) of PSD2.

- Reclaim customer loyalty and retain customers by offering /wiki/spaces/OB200/pages/48629460//wiki/spaces/OB200/pages/48629460 services. Banks can create a one-stop banking portal combined with proper financial management capability, federated authentication, fraud detection, and dashboards.

- Digitally transform a business by offering innovative services that go beyond banking.

See the diagram below for details on what WSO2 offers at each stage:

Figure: The WSO2 Open Banking solution