Open banking is a mechanism that enables financial institutions to securely, and with the consumer’s consent, expose data and services (e.g., account information, payment initiation) via standardized APIs to authorised third parties. These third parties, including app developers and other financial institutions, are in turn able to build new financial services offerings for consumers using the data and services made available through open banking APIs. Open banking gives consumers more control over their data, offers greater financial transparency, a more equal chance of success for all financial service providers, and importantly, more innovative services for customers that match their current requirements.

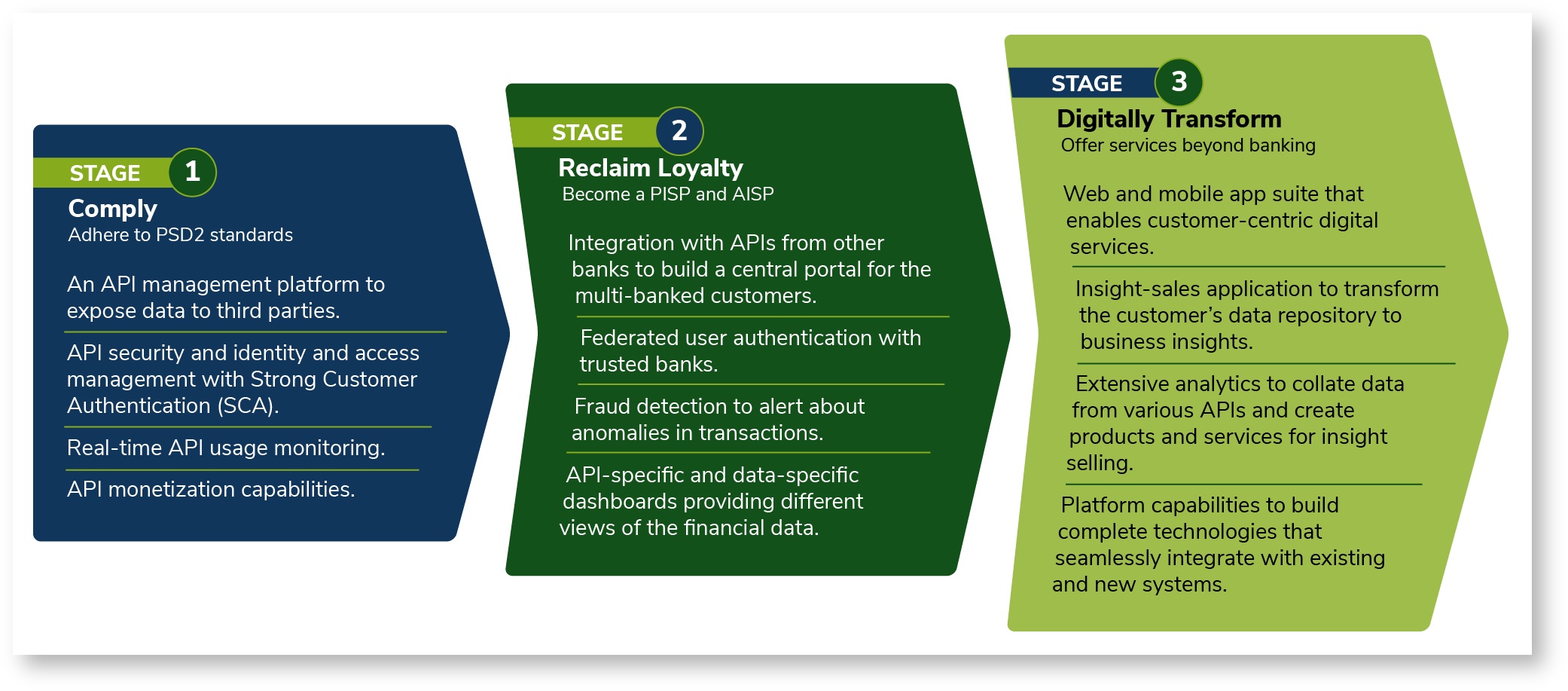

WSO2 Open Banking provides the technology requirements that banks need in order to become digitally transformed in three stages. It leverages five key technology areas critical to a banking infrastructure—API Management, Identity and Access Management, Integration, Data Analytics, and IoT.

- Become open-banking specification compliant by exposing APIs securely and in-line with the Regulatory Technical Standards of the open banking specifications (Payment Service Directive 2, Consumer Data Right).

- Reclaim customer loyalty and retain customers by offering AISP/PISP services. Banks can create a one-stop banking portal combined with proper financial management capability, federated authentication, fraud detection, and dashboards.

- Digitally transform a business by offering innovative services that go beyond banking.

See the diagram below for details on what WSO2 offers at each stage:

Figure: The WSO2 Open Banking solution